Payment Wallet - Case Study

The client is a global IT Solutions and Management Consulting Company which helps the business users to setup pay-in & pay-out correspondent relationships for banks, money exchanges & money transfer, cross border remittance & payments business, payroll processing systems & electronic transaction processing services.

Website: www.workerappz.com

Brand: Workerappz

Industry: Fintech

Location: UAE & Other parts of World

Core Platform Mobile | iPhone | Android

Programming Language: PHP, Kotline, REST, Objective C

Framework: YII 2.x,

Database: MYSQL

3rd Party API: RitmanPay, Ding Mobile recharge, Braun Cards (Prepaid cards APIs)

Corporates, Individuals, Employees, Migrates, Parents, Students

UAE,USA, UK, Africa, Europe, Asia, Australia, China

Challenges

- Improper banking infrastructure in some countries.

- Lack of consistency in business.

- Huge cost in transferring money to one country to another country.

- Cross-border payment complexities.

- Loss of money during the exchange rate.

- Compiling worldwide KYC

- Restriction of money exchange in certain countries

- Realtime exchange rate calculations

- Designing Agent/contractor workflow as they are not technology savvy

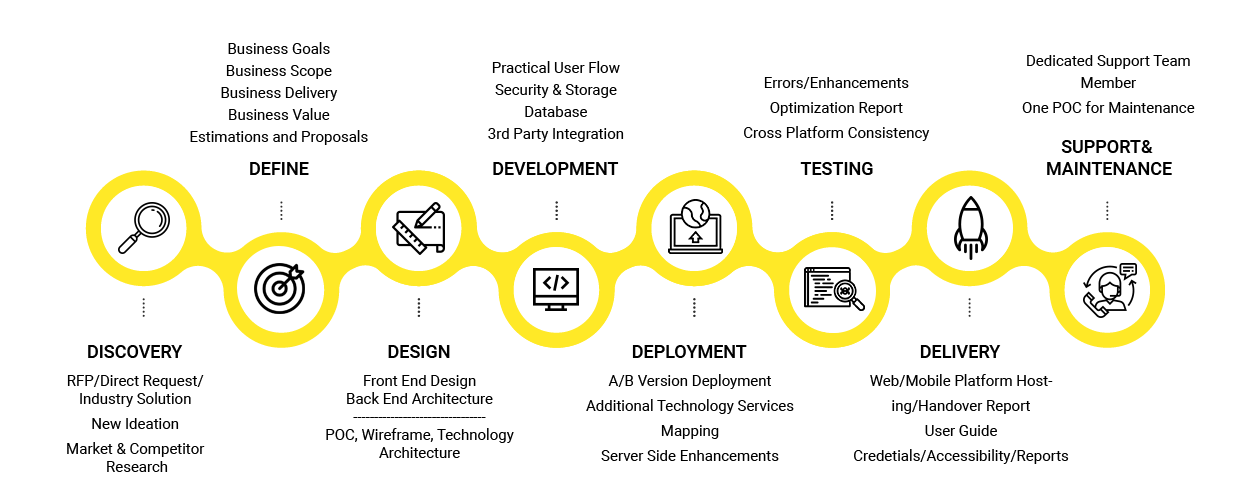

Strategic Approach

The client's requirements were not feasible outrightly, there were several challenges related to conducting the realtime exchange rate calculations, compiling worldwide KYC, and other legislative restrictions on money exchange across various countries.

After a comprehensive analysis of the client’s business, we discovered that there involves a huge cost of transferring money from one country to another. Also, there is a substantial loss of money during the exchange rate and the bottleneck of sending money to families especially where no proper banking infrastructure is placed is a challenge. All these factors contributed to a huge delay in sending money. So we identified that the client business can achieve efficiency by developing an ecosystem that accommodates the needs of everyone’s lives worldwide with addressing their payment requirements whenever and wherever they needed.

Before the actual project started the documentation we collected to ensure we are building the right application was:

- RFP

- SOW

- Design documents

- Sample Data/Physical Printed Forms of current manual process

- Allow the client in utilizing the solution for its own existing customers and extending the customer base.

- Allowing the offshore family members to do frequent money transfers to their homes without having to pay high transaction charges.

- Reduce the time spent by the Companies/contractors on the payout process to laborers,

- Scaling the client’s existing exchange control system into the Digital Wallet.

- Providing user of the app with the prepaid wallet.

- Recharge mobile

- Pay bills

Project Development

iPhone Developers

Android Developers

Project Manager

Designer

Backoffice Developers

API Developer

Quality Analyst

Business Analyst

Scope :

- KYC

- TOP-UP

- Money transfer

- Pay Bills

- Prepaid card

- Quick payments

- Transaction history

- Beneficiary management

- Onboarding of customers via mobile application.

Timeline : 6 Months

Project Highlights

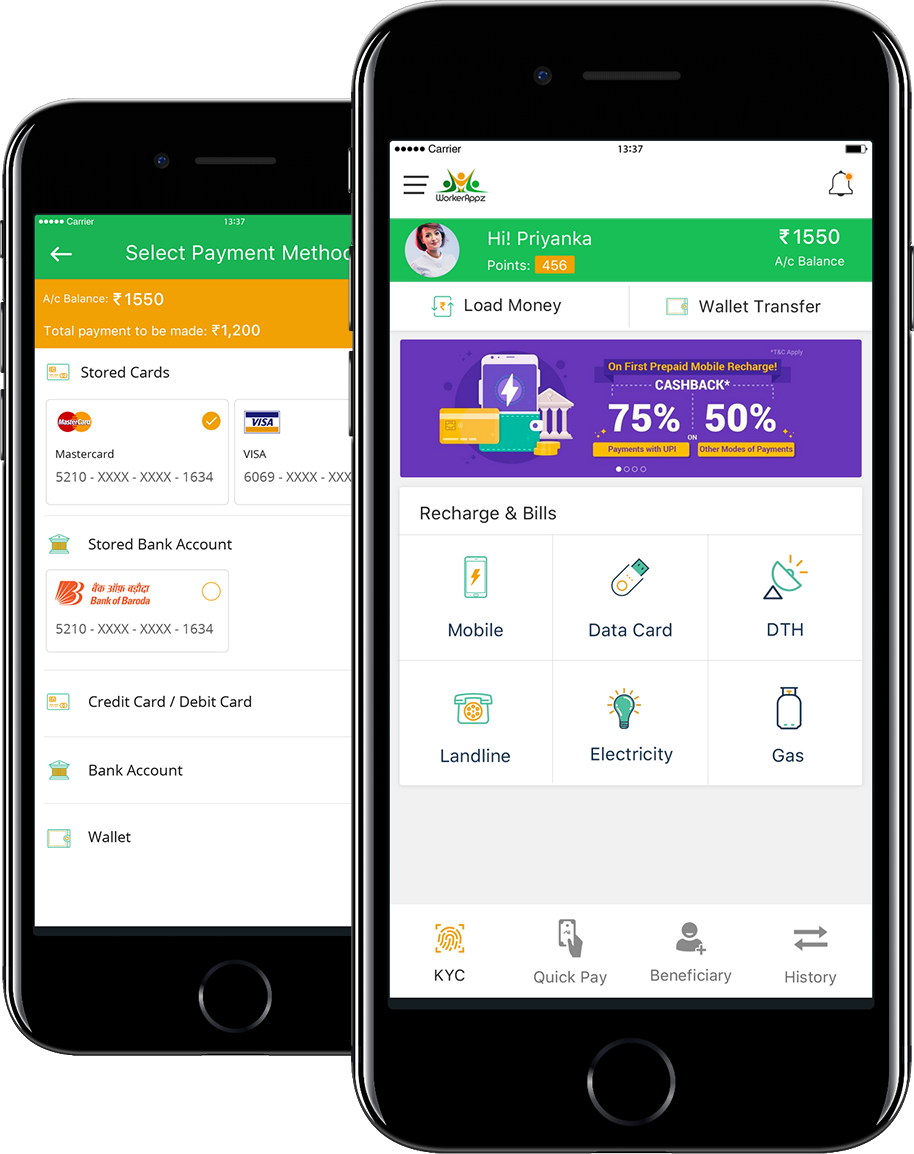

Application Features

- Cross border money transfer

- Beneficiary management

- Bills Payment

- Prepaid card

- Quick payments

- Transaction history

Key Highlights

- Cross border money transfer.

- Cross border recharge.

- Cross border Bill payments.

Key Takeaways and Learnings

It was a unique experience of learning about the entire process of how cash payments like western union work.

We also learned how the cross broader remittances work through various agents and process.

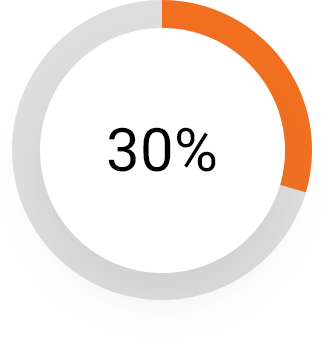

Achieved Client Base

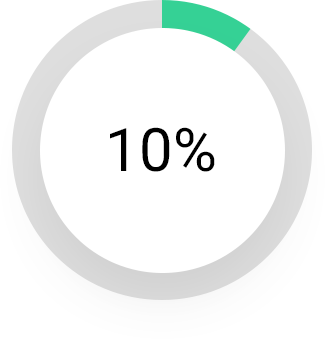

Reduction in Time & Cost

Business Impact

- The application helped in automating several work processes to drive efficiency and growth.

- The company successfully achieved a 30% client base across the globe.

- The application helped in reducing 10% time and cost of transferring money to another country.